Instant Payments

Payment systems around the world are changing fundamentally to meet a growing demand for immediate payments and increasingly digital solutions. Instant Payments are set to drive the most significant transformation in the global payment landscape, as customers are expecting convenience and security as well as rapid, instantaneous processing of all their transactions. Instant Payments are the new normal.

What are Instant Payments?

Instant Payments means paying or receiving payments instantly. Instantly means within a few seconds, anytime, 24/7 365 days a year. Instant Payments are also known as 'immediate payments' and 'real-time payments'. It is the ability to move funds instantly, clearing the transaction and crediting the payee's account with confirmation to the payer within seconds of payment initiation, between people, businesses and government authorities.

Read about our solution RealTime24/7

How can Instant Payments help your business?

The payment industry is moving at a rapid pace. E-commerce, goods and services are traded every second of every day. Payment providers all around the world need to stay ahead of the curve to:

How can you succeed with Instant Payments?

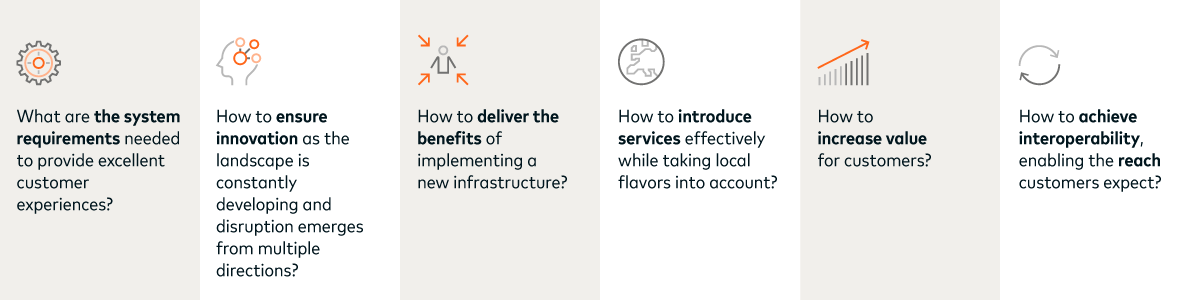

For banks and communities looking to seize opportunities, meet customer expectations and avoid market risks, the fundamental question when implementing Instant Payments has evolved from 'if and why' to 'how and when'. This crucial question can be divided into six sub-questions that are essential for adopters of Instant Payments to ask themselves to create a successful implementation strategy.

We are a strong provider of Instant Payments

Our track record and reputation prove that we are an experienced Instant Payments solution provider both in the Nordic and European countries. Our solution is based on a microservices architecture, using modern technology and design principles.

Our ability to deliver real-time clearing services with an open API architecture permits easy customer delivery of services in a trusted environment. We have proven to be a stable and reliable supplier in the implementation process.

Four reasons why we are your best partner for Instant Payments

Instant Payments are a strategic core area for us and we have pioneered the technology in the Nordic countries and beyond since 2014. This means we will continue to invest heavily in Instant Payments. We will also continue to take responsibility for driving the global Instant Payments infrastructure forward by engaging in European standardisation and collaboration initiatives. The nine billion transactions we facilitate every year give us the scale to prioritize innovation and allow for investments in order to stay at the forefront of Instant Payments technology as it develops.

Our European activities

We connect banks, merchants, corporates, public authorities and consumers, delivering payment services and related technology solutions across the continent.

Live Instant Payments solution

Developing Instant Payments solution

Other clearing activities

Other operations by us

Did you know?

... that we also offer an Open Banking platform?

The wide availability of Instant Payments creates new opportunities in open banking to serve internal bank applications, corporate clients and Fintech partners with better and faster access to data and payments.

We have utilised our instant technology for open banking access as well, to provide a high-performance solution allowing both banks and PSPs to fully use the new instant financial services. Open Banking Access gives you as a third-party provider (TPP) everything you need in the new era of open banking.

Go to Open Banking Access

{

"error": null,

"ribbons": [

{

"id": "ctl00_PlaceHolderMain_RibbonPanel12_wrapper",

"color": "#f6f6f6",

"image": null,

"overlay_alpha": null

},

{

"id": "ctl00_PlaceHolderMain_RibbonPanel4_wrapper",

"color": "#e3dfd7",

"image": null,

"overlay_alpha": null

},

{

"id": "ctl00_PlaceHolderMain_RibbonPanel15_wrapper",

"color": "#141413",

"image": null,

"overlay_alpha": null

},

{

"id": "ctl00_PlaceHolderMain_RibbonPanel17_wrapper",

"color": "#141413",

"image": null,

"overlay_alpha": null

},

{

"id": "ctl00_PlaceHolderMain_RibbonPanel9_wrapper",

"color": "#141413",

"image": null,

"overlay_alpha": null

},

{

"id": "ctl00_PlaceHolderMain_RibbonPanel10_wrapper",

"color": "#ffffff",

"image": "/SiteCollectionImages/background/mastercard_1920x600_brandcircle_connections.png",

"overlay_alpha": null

},

{

"id": "ctl00_PlaceHolderMain_RibbonPanel11_wrapper",

"color": "#ffffff",

"image": null,

"overlay_alpha": null

},

{

"id": "ctl00_PlaceHolderMain_RibbonPanel2_wrapper",

"color": "#f6f6f6",

"image": null,

"overlay_alpha": null

},

{

"id": "ctl00_PlaceHolderMain_RibbonPanel3_wrapper",

"color": "#ffffff",

"image": null,

"overlay_alpha": null

},

{

"id": "ctl00_PlaceHolderMain_RibbonPanel14_wrapper",

"color": "#e3dfd7",

"image": null,

"overlay_alpha": null

},

{

"id": "ctl00_PlaceHolderMain_RibbonPanel16_wrapper",

"color": "#2f2f2f",

"image": null,

"overlay_alpha": null

},

{

"id": "ctl00_PlaceHolderMain_RibbonPanel8_wrapper",

"color": "#ffffff",

"image": null,

"overlay_alpha": null

},

{

"id": "ctl00_PlaceHolderMain_RibbonPanel6_wrapper",

"color": "#2f2f2f",

"image": null,

"overlay_alpha": null

},

{

"id": "ctl00_PlaceHolderMain_RibbonPanel13_wrapper",

"color": "#e3dfd7",

"image": null,

"overlay_alpha": null

},

{

"id": "ctl00_PlaceHolderMain_RibbonPanel7_wrapper",

"color": "#2f2f2f",

"image": null,

"overlay_alpha": null

}

]

}